Goals are the glue that holds a company together. Setting the right business goals help all the people in a company—from customer support to sales—align around making progress and moving forward to a shared vision.

They don’t just help a company’s bottom line either. Research shows that goals help increase the drive and persistence of the people who are trying to achieve them.

Goals give your company the capacity to incentivize and motivate your team toward specific action.

For a finance department, though, setting team goals can be extremely tricky. Other teams in a company often have clear goals to drive the business forward: “Decrease churn by 20%” for your product team, or “Increase user sign-ups by 4x” for marketing. Within a finance department, it isn’t always clear how specific goals connect to the growth of the business—they’re often more focused around managing cash flow or containing costs.

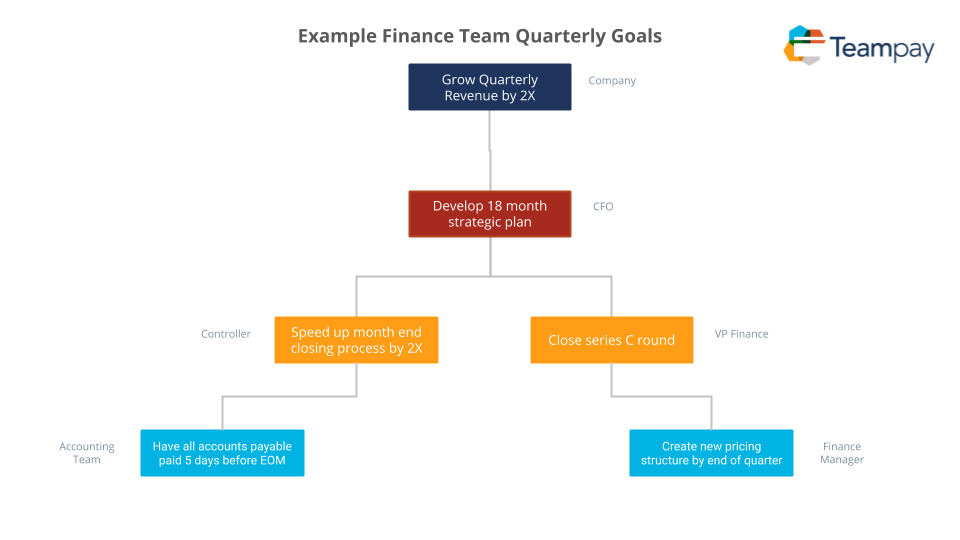

For goals to succeed, you have to be able to connect them to the broader trajectory of what your company’s trying to do. You have to connect the dots between the bigger strategic goal of your company, the operational goals of your team, and the individual goals of your people.

Company Goals = Team Goals + Individual Goals

“Grow Quarterly Revenue by 2x”

The goal above sounds great—who doesn’t want to double revenue for their company? It provides a clear, quantifiable goal that can be tracked and measured. It’s aggressive but possible.

Delivered on high from the CEOs desk, however, it’s just a loose statement of intent. Increasing revenue by 2x isn’t going to be achieved by the CEO or even the executive team—it’s accomplished by the engineers, salespeople, support reps, and marketers on the ground.

That means to achieve these big goals, individual teams need their own set of goals to move the ball forward.

In a finance team, this begins with the CFO:

In the diagram above the finance team has a clear and actionable goal—to structure an 18-month plan for the finance team. There are two things that make this challenging:

- The CFO doesn’t have all the information to execute. The CFO isn’t necessarily aware of a payroll hiccup in the accounting department or the VCs that the finance department is talking to for funding. That means they have to meet with individual managers, gather information, and set realistic targets that make sense.

- The CFO has to delegate responsibility. While the CFO is responsible for the strategic plan, it’s the rest of the department that executes. That means the finance team has to participate in putting the plan together.

The CFO’s strategic goal

Big, hairy, audacious goals always sound great—but the bigger the goal, the less actionable it is. That’s why the first thing a CFO has to do is break a big goal into smaller ones that can be achieved within discrete periods of time.

This could look something like:

- Gather feedback on a strategic plan by C-Suite executives by March 3.

- Set acquisition targets with VP of Marketing by March 10.

- Set new bookings targets with VP of Sales by March 10.

- Set hiring capacity with Director of HR by March 10.

- Get the green light on plan from CEO by March 17.

By breaking down a bigger goal into smaller, easier goals, you’re able to compartmentalize your time and work more efficiently. The more you can break your goals down into their composite parts, the easier they become to achieve. The magic thing about small wins is that they compound over time into a big one.

Setting Individual Team Goals

While the CFO might succeed in putting together a strategic plan for the department, this doesn’t actually matter unless individual team members can execute their own goals. These vary from team member to team member:

- Finance Manager: Test new pricing structures.

- Accounting Team: Process accounts payable one week prior to the end of each month.

- VP Finance: Close funding round for Series B.

As with the CFO, each team member needs to split up their big goals into smaller parts. For example, if the VP of Finance wants to close the company’s Series B round by the end of the quarter, that big goal needs to be broken down into smaller achievable goals:

- Finalize pitch deck by March 20.

- Prepare statement of company financials and business metrics by March 25.

- Prepare legal documents by March 30.

- Reach out to existing investors by April 7.

- Prepare list of initial leads by April 12.

What quickly becomes obvious when each team member begins to break individual goals into shorter steps is that these goals aren’t really “individual” or even restricted to the finance team. For accounts payable to be paid on time, the accounting team might need other teams to submit their expense reports sooner. The VP of Finance needs to enlist help from the company’s founders to close the Series B round and so on.

Breaking down big goals into smaller ones doesn’t just help keep individual team members accountable—it provides greater transparency across the company and collaboration. It makes team members assess how they can achieve their goals by working together.

A Three-Step Process for Setting and Achieving Team Goals

While breaking big goals into smaller ones is a powerful best practice for getting stuff done, it’s not enough. You have to keep your team on track and accountable to meet the goals that they’ve been set. That means not just thinking about revenue targets or sales quotas but how to augment individual team members and position them for success.

Let’s walk through a three-step process for making this happen.

1. Pick achievable goals

The first and most important step to achieving team goals is to make sure that your team actually has the capacity to achieve them. While this sounds obvious, it’s one of the biggest reasons ambitious goals fall short in practice.

In a finance department, take the long-term goals of the business as a whole as a starting point. Look at your bookings and revenue targets across the history of the company. Your long-term goals—and the overall financial health of the company— depend on your ability as a business unit to forecast revenue and determine the practical steps for getting there.

Scale Venture Partners recommends framing long-term goals like so:

What—from a business perspective, not a purely financial perspective—is the company trying to achieve? The financial plan should map to these goals and should be judged in that context.

2. Communicate your goals

Telling your goals to team members and other people at the company is the next critical component in making them happen. Managers and executives need to clarify what the goals are, why they’re important, and how they’ll be measured. For a finance team, this typically involves digging deep into the numbers.

Budgeting, key metrics, and sales targets need to be forecasted accurately to provide a framework for tracking goals and holding people accountable to them.

While it’s important to set goals, it’s also important to keep in mind that they’re often a moving target. If a bunch of new competitors enters the market in the middle of the quarter, you need to readjust your goals and communicate them to the team. Remember that goals aren’t set in stone—they’re a moving target meant to unify your team.

3. Track your goals

Measuring success around goals and holding people accountable to them is critical to making progress as a company. You need the ability to identify what’s working and what’s not.

There are a number of ways to do this across your team:

- 1:1 meetings help managers keep a finger on the pulse of the team and identify blockers to success for specific team members. They also give managers a window into the broader career goals of individual team members and how they can align team goals with individual goals.

- Presentations on a weekly or monthly basis allow your team to keep up-to-date on the progress around your goals. They also help hold team members accountable, as it’s a form of self-assessment across the whole team.

- Reports force your team to look closely and scrutinize progress and identify any roadblocks in the way. They also help keep managers up-to-date on big pushes that would otherwise feel intangible. Don’t be afraid to automate any reports you can to save time.

Finance teams are responsible for keeping the gears turning in any business—and this can create a high-pressure environment. Tracking goals and staying accountable, whether in the form of a 1:1 or in an all-hands, can help team members keep their eyes on the prize and make incremental progress toward big goals.

Goals Align Your Team

The most important thing to remember is that goals exist to help pull your team together and work as a unit. They’re the north star of where you want to go, and they guide all your different operations toward the same shared goal.

Being clear and pragmatic about the goals you set is the key to success. Your people want to feel like what they’re doing matters and will make all the difference in your company—so help them do exactly that.

This is a guest post from Teampay, a corporate credit card built for teams. Teampay gives your company control over purchases, allowing you to request, approve, and track purchases in real-time. To learn more about setting and managing financial goals for your company, check out the Teampay blog.

P.S. If you liked this article, you should subscribe to our newsletter. We’ll email you a daily blog post with actionable and unconventional advice on how to work better.